TCI Capital Management LLC (TCICM) - a CLO loan manager. Tetragon Credit Income Partners (TCIP) - TCIP acts as a general partner of a private equity vehicle that focuses on CLO investments relating to to risk retention rules, including majority stakes in CLO tranches. Hawke’s Point – a business that seeks to provide capital to companies in the mining and resource sectors. Polygon Global Partners – a manager of open-ended hedge fund and private equity vehicles across a number of strategies.Įquitix – an integrated core infrastructure asset management and primary project platform. On 27 July 2022, the Board of Directors of Tetragon declared a dividend of U.S.0.11 (11.00 cents) per share in respect of the second quarter of 2022. The GreenOak Real Estate joint venture – a real estate-focused principal investing, lending and advisory firm.

LCM Asset Management – a CLO loan manager.

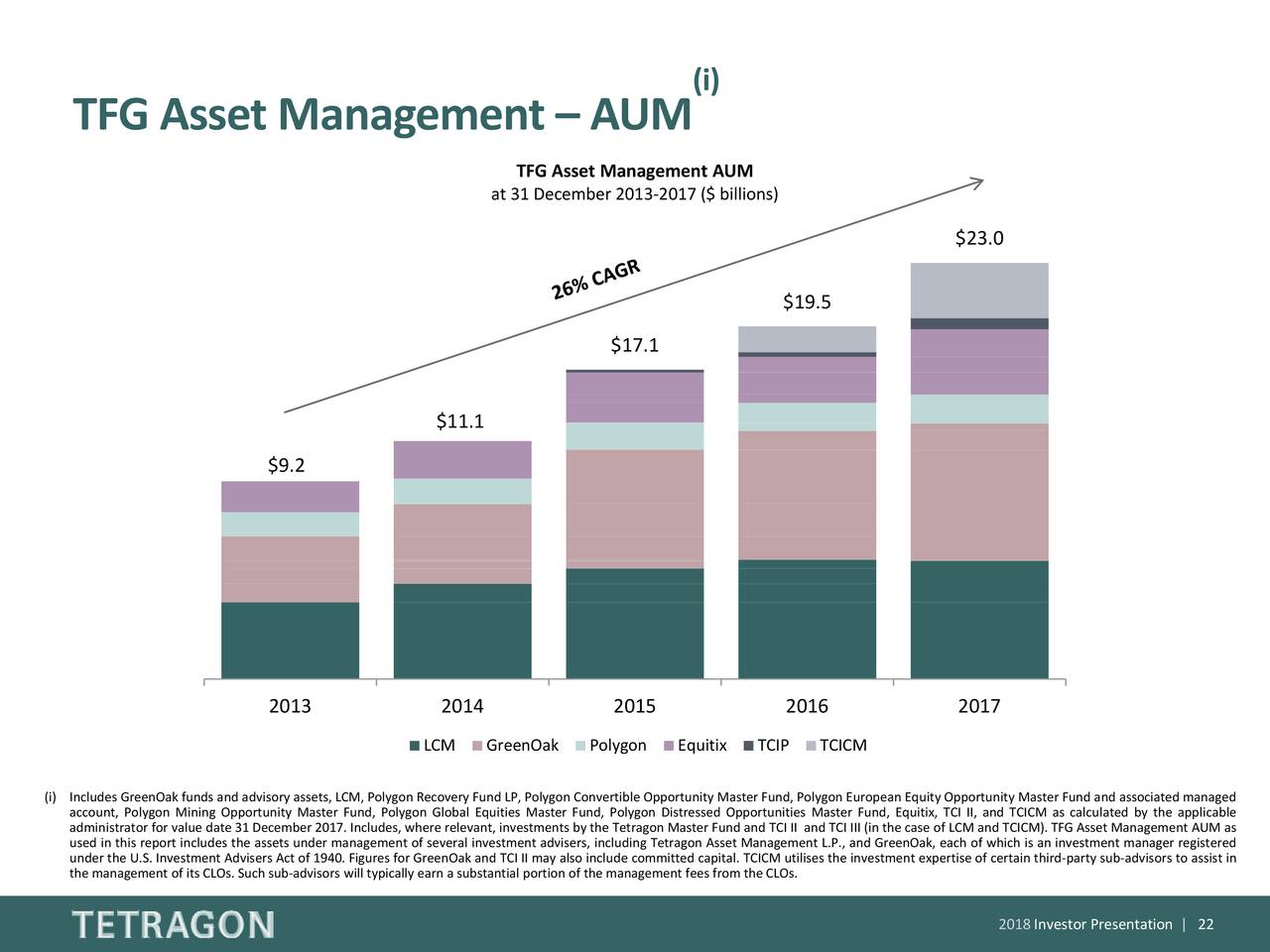

TFG’s fair value(i) net asset value as of 30 September 2016 was approximately $1.9 billion. The company’s investment portfolio comprises a broad range of assets, including a diversified alternative asset management business, TFG Asset Management, and covers bank loans, real estate, equities, credit, convertible bonds and infrastructure. It aims to provide stable returns to investors across various credit, equity, interest rate, inflation and real estate cycles.

TFG's investment objective is to generate distributable income andĬapital appreciation. under the ticker symbol “TFG.NA” and on the Specialist Fund Segment of the Main Market of the London Stock Exchange under the ticker symbol “TFG.LN”. Tetragon Financial Group Limited, or TFG, is a Guernsey closed-ended investment company traded on Euronext Amsterdam N.V.

0 kommentar(er)

0 kommentar(er)